How Much Money Can I Send Abroad from the UK?

International transfers can be tricky. If you go about it the wrong way, you may face delays and inconveniences. Or worse, you may find yourself dealing with legal problems or having your account withheld on suspicion of money laundering.

To help you do it the right way, we’ve prepared a guide to walk you through everything you need to know about sending money from the UK.

How Much Money Can You Send Abroad From the UK?

UK laws don’t specify any limit for sending money overseas, whether through the bank or online and wire transfer.

However, because of the risk of money laundering, providers of money transfer services often set their own limits. For instance, the following are the international money transfer limits set by the UK’s big banks.

- Natwest: £25,000

- HSBC: £50,000

- Barclays: £50,000

- Lloyds: £30,000

Specialist FX transfer providers often have higher limits than banks. Some will allow you to send £100,000 or more in one go.

What Are the Tax Implications of Sending Large Sums Abroad?

There is no tax imposed on international payments from the UK, so the tax implications will solely depend on the laws of the country you are sending money to.

UK tax laws will only come into play if you want to receive money from abroad, in which case it will depend on where you are ‘domiciled’. Note: For tax purposes, domiciled refers to where you ordinarily pay tax, not where you are currently living.

Is It Safe to Send Large Amounts of Money Abroad?

The safety and security of your payment depend on your chosen service provider. Choose a transfer service that’s registered and regulated by the Financial Conduct Authority (FCA).

The process of getting registered by the FCA is quite stringent. For instance, it involves:

- A background check on the primary decision-makers of the business.

- A review of the business's financials.

- A detailed analysis of the systems and controls.

In addition, the regulation by the Financial Conduct Authority is rigorous enough to ensure that customers are protected. So, take a look at the FCA’s register to see if your chosen transfer partner is listed.

It’s also important to check online reviews to see what other customers have to say about the money transfer firm.

Key Considerations for Sending Money Abroad

Which Platform Should I Use?

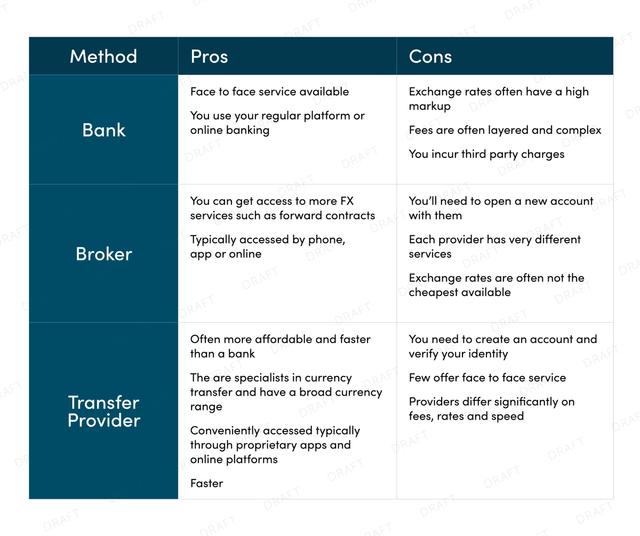

There are typically three main ways of sending money from the UK:

- A bank which sends the money to another bank account.

- A money transfer company.

- A foreign exchange broker.

The table below outlines the pros and cons of each method.

Specialist transfer firms are often the best way for sending money abroad because:

- They specialise in international transfers, which makes them more efficient.

- While they are well-regulated just like banks, they are streamlined enough to still be convenient.

- Most avoid the SWIFT network, so there are no third-party payments, resulting in cheaper fees.

What Information Do I Need?

The information you need depends on the method of transfer that you choose and which country you are sending the money to.

You will typically require the following:

- Recipients name and identification particulars.

- The receivers IBAN which is a standardised 34-character string. It comprises four letters representing the country code, four letters that stand for the bank’s name and a series of numbers showing the sort code and receiver’s account number.

- The SWIFT or BIC code. SWIFT codes identify specific banks and financial institutions. They are made up of 8 –11 characters that show the bank’s name, country, location and branch.

- National clearing code or routing code (for countries that don’t use SWIFT or BIC).

What Documents Will I Need to Make an International Transfer?

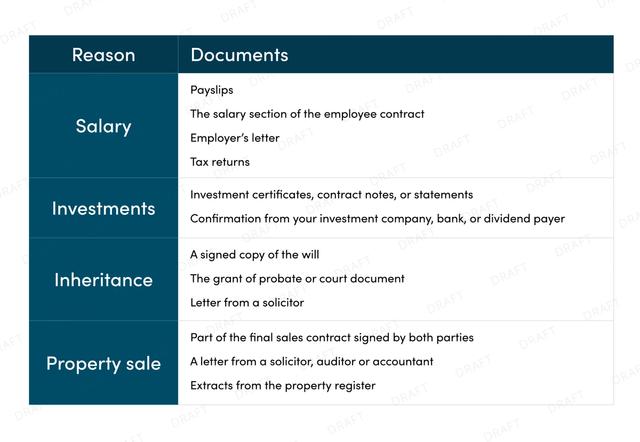

If you’re sending large sums of money, you will often be asked to verify the source of funds by providing your bank statement for the past three months.

The table below shows what else you may need, depending on what the money is for.

Tips for Sending Money Abroad

- Check the firm’s registration with the FCA to ensure your funds are in safe hands.

- Find the most competitive exchange rate available.

- Check the costs and fees of sending money. Some international money transfer services offer free transfers. However, double check that the prices aren’t hidden under a poor exchange rate.

- Compare the speed of transfer of different service providers.

- Look for a payment provider that allows you to transact in many foreign currencies.

- Keep any paperwork, online confirmations and receipts to protect yourself and help you trace your payment in case it doesn’t go as planned.

- Let the recipient know how much and how they will get the money to ensure they get the right amount.

- Triple check all details before processing the transaction.

- If you use a password, choose a strong and unique one with a combination of letters, numbers and symbols. Avoid using obvious choices like birthdays or your pet’s names.

What Else Should You Keep in Mind When Sending Large Amounts of Money?

If you exceed the service provider’s limits, you will have to complete your transaction in trunches, which will cost you more in transaction costs. It’s also important to find out if the provider doesn't deduct fees from the recipient since it will impact how much they receive.

Can I Send Cash In the Mail?

There is no law against sending cash in the mail in the UK. However, it’s not advisable to do so, especially for large amounts of money. It’s also important to consider that it’s illegal to send cash via mail in some countries such as India.

Bottom Line

- There’s no legal limit to what you can send. However, providers cap the amount at different levels.

- You should find a safe and reliable FCA regulated entity for sending large amounts.

- Money transfer services are typically the best way to send abroad because they are cheaper and more convenient than banks.

Fast, Easy and Reliable International Payments With Clear Currency

Choose Clear Currency for quick and safe transfers. We support over 35 currencies, plus the whole process is fast and efficient. If you hit a snag, you can reach out to our customer services team for help.

Get in touch with Clear Currency and let us handle all your international transactions in a smooth, speedy and affordable manner.

Related Articles

How to Mitigate Foreign Exchange Risk

Currency risk can have a significant effect on the efficiency and profitability of any international business. Each exchange rate movement affects how much you receive from sales and what you pay to suppliers.

Read more

Moving to Dubai from the UK: Checklist

You’re ready for a new life overseas and have decided you’re moving to Dubai. Now it’s time to consider the various costs involved, from your visa and accommodation, to health insurance, shipping your belongings and bringing your beloved pets along too.

Read more

Currency Outlook Quarter 1 2023

Clear Currency looks back at the performance of the US dollar, euro and sterling in Q4 2022, and assesses what might be in store for Q1 2023.

Read more