Cost of Living Comparison: UK and Australia

The next time you hear someone say “Australia is one of the best places to live in the world” you can rest assured they’re speaking the truth - just look at the global rankings: twelfth happiest country in the world, sixth in terms of quality of life and Sydney and Melbourne always feature in the numerous lists of top ten cities.

And it’s easy to see why: low unemployment, high salaries, beachfront cities, endless space and a sun-drenched outdoor lifestyle in spectacular surroundings. From Melbourne’s cosmopolitan energy, Sydney’s glorious harbour, and Perth’s remote tranquillity to the vast ochre plains that are affectionately known as “the outback” - and everything in between - this ancient land is enticing. So much so that in 2019 it was estimated that almost 1.2 million people who were born in the UK were living in Australia.

If you choose to join them - whether it’s for work, retirement or a new life - you’ll be blessed with an envious lifestyle that’s defined by endless summers and adventures as vast as the horizon. Before you start booking your flight to the other side of the world, however, there’s much to consider to ensure your move there will be a success - not least the cost of living.

To help you assess if your potential move to Australia is financially viable, we have compared the cost of living in the UK with Australia using figures from numbeo.com - a crowd-sourced global database of perceived consumer prices.

What is the average cost of living in the UK and Australia?

UK

- Average cost of living for a single person: £657.58 per month without rent

- Average cost of living for a family of four: £2,284.45 per month without rent

Australia

- Average cost of living for a single person: £759.87 per month without rent

- Average cost of living for a family of four: £2,735.61 per month without rent

What is the average cost of living in London and Sydney?

London

- Average cost of living for a single person: £884.24 per month without rent

- Average cost of living for a family of four: £3,056.38 per month without rent

Sydney

- Average cost of living for a single person: £824.53 per month without rent

- Average cost of living for a family of four: £2,994.19 per month without rent

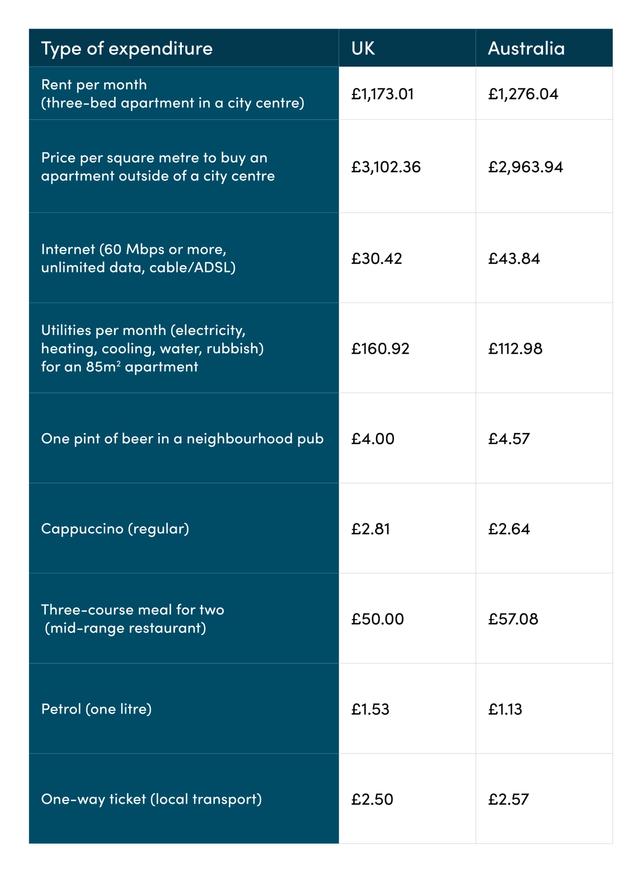

Typical costs you can expect to pay

What is the average salary in the UK and Australia?

UK

- Average monthly net salary (after tax): £2,287.17

Australia

- Average monthly net salary (after tax): £3,258.56

London

- Average monthly net salary (after tax): £2,977.04

Sydney

- Average monthly net salary (after tax): £3,664.05

Price comparison overview

UK versus Australia

- Consumer prices in Australia are 20.23% higher than in the UK (not including rent)

- Consumer prices in Australia including rent are 18.13% higher than in the UK

- Rental prices in Australia are 13.77% higher than in the UK

London versus Sydney

- Consumer prices in Sydney are 2.80% higher than in London (not including rent)

- Consumer prices in Sydney including rent are 5.92% lower than in London

- Rental prices in Sydney are 17.36% lower than in London

- Local purchasing power in Sydney is 30.83% higher than in London

Currency risk exposure

You’ve crunched the numbers and calculated that you can afford the move to Australia - from buying a property to buying a pint. But, don’t forget that your money will have to move with you, exposing it to currency market risk, which - along with transfer fees - can erode the amount that arrives Down Under.

Currencies are traded around the clock - 24 hours a day. Therefore, the value of the pound against other currencies is constantly changing - not just daily but by the minute. Why do they fluctuate in value? Currencies strengthen and weaken each day because banks and investors purchase huge volumes in response to political and economic news: positive news about a country typically causes the value of the currency to rise (“strengthen”), while bad news causes it to fall (“weaken”).

We also know when they might move because we often know the timing of political events that might influence them, and the economic calendar shows us when influential economic data will be released. However, there will also be news that happens without warning - anything from an unexpected surge in US nonfarm payrolls to a fall in the price of bauxite.

What we cannot predict – and no one can – is whether they will move up or down or by how much. Even slight fluctuations can make a big difference to the price of your international payments. In some instances, the impact of the political and economic variables that influence exchange rates can be severe, as has been proved in recent times. For example, in March 2022 the pound slumped to the lowest since December 2020 as traders flocked to the safe-haven dollar amid an escalation in the Ukraine war.

Before the pandemic struck, this exposure to currency market risk had the potential to drive up the cost of sending money overseas if left unaccounted for. Since then, however, the importance of mitigating the impact of exchange rate fluctuations on the cost of your international payments has been magnified. This has shone a spotlight on the need to seek the services of a currency specialist.

Clear Currency

Clear Currency specialises in helping clients who are moving overseas to save money when making international payments.

Converting large sums of money into another currency and transferring them overseas can be daunting and confusing. Aware of this, we use our knowledge and experience to cut through the jargon and give you a friendly and personal service.

We recognise that it’s impossible to accurately predict how exchange rates will perform; therefore, it’s prudent to plan for all eventualities. With this in mind, we will assign you a dedicated account manager who will work in partnership with you throughout the payment process. In addition to helping you benefit from quick, easy, reliable and secure transfers, they can help you mitigate the impact of currency risk on your budget.

For example, fluctuating exchange rates make it hard to judge how much you’ll pay at any one time; therefore, your account manager can help you execute a forward contract to secure the cost of your payment. This allows you to lock in an exchange rate for a date in the future, securing the amount of money that arrives in your Australian bank account when the time comes to execute the payment.

Related Articles

How to Mitigate Foreign Exchange Risk

Currency risk can have a significant effect on the efficiency and profitability of any international business. Each exchange rate movement affects how much you receive from sales and what you pay to suppliers.

Read more

Moving to Dubai from the UK: Checklist

You’re ready for a new life overseas and have decided you’re moving to Dubai. Now it’s time to consider the various costs involved, from your visa and accommodation, to health insurance, shipping your belongings and bringing your beloved pets along too.

Read more

Currency Outlook Quarter 1 2023

Clear Currency looks back at the performance of the US dollar, euro and sterling in Q4 2022, and assesses what might be in store for Q1 2023.

Read more